Strategy

Content

Discover our 'Elevate to 2030' strategic plan

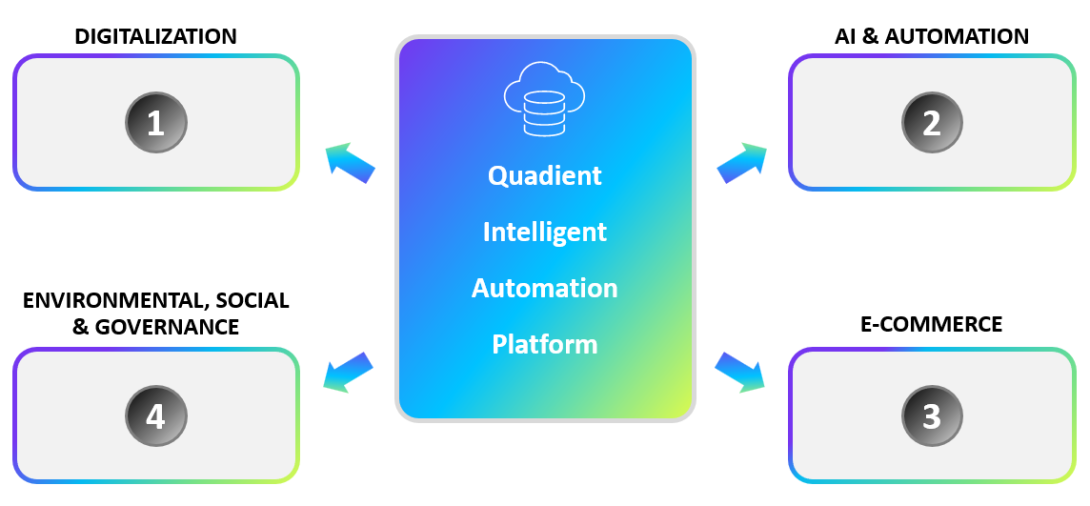

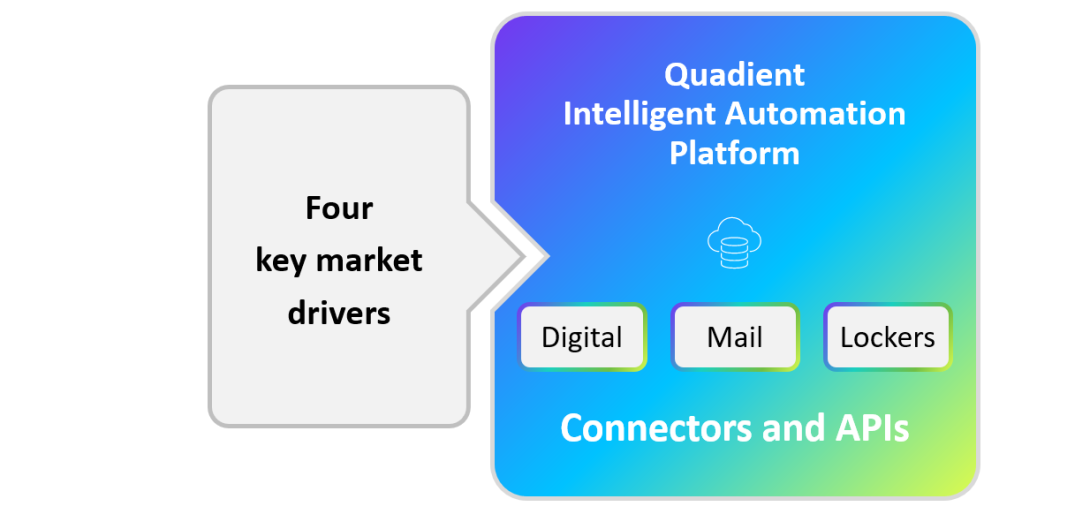

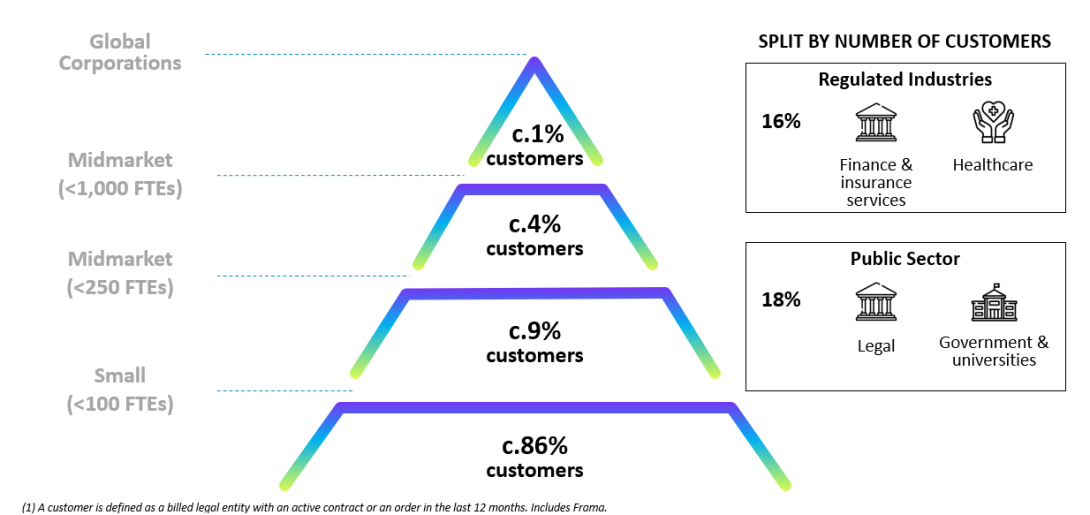

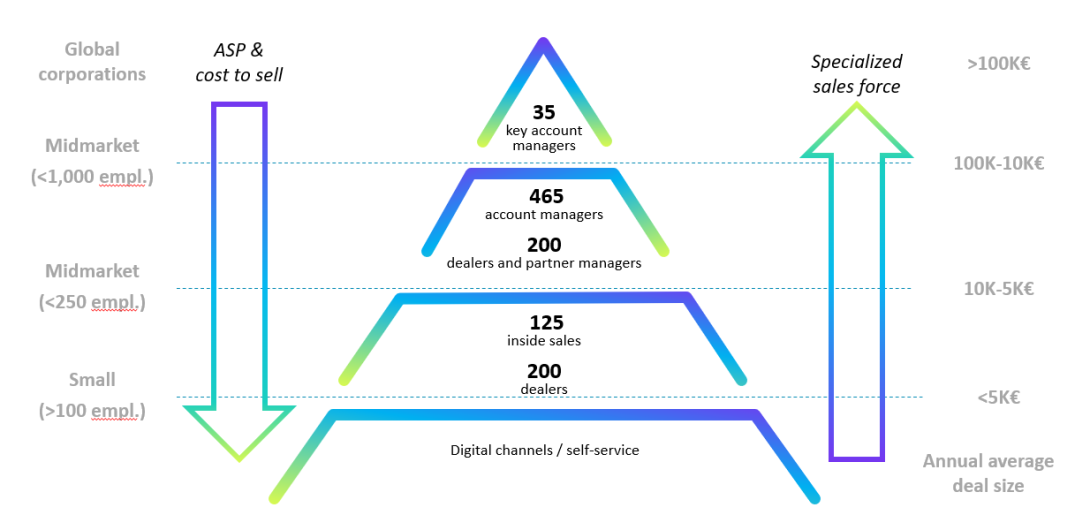

Over the past five years, Quadient has built a solid foundation, thanks to the execution of the "Back to Growth" strategic plan, which was completed in early 2024. This plan allowed for a clear repositioning of Quadient as an intelligent automation platform that provides essential services to around 350,000 companies of all sizes, supporting them in their digital transformation.

Based on a customer-centric culture and supported by a recurring and sustainable business model, the new strategic plan, "Elevate to 2030", offers strong financial prospects built around around an acceleration of recurring revenue growth, higher profitability, and a disciplined capital allocation policy throughout the duration of the plan.

Strategically positioned to deliver strong and attractive 2030 ambitions

Image

Customer value

"ELEVATE TO 2030", IN NUMBERS

Page Type